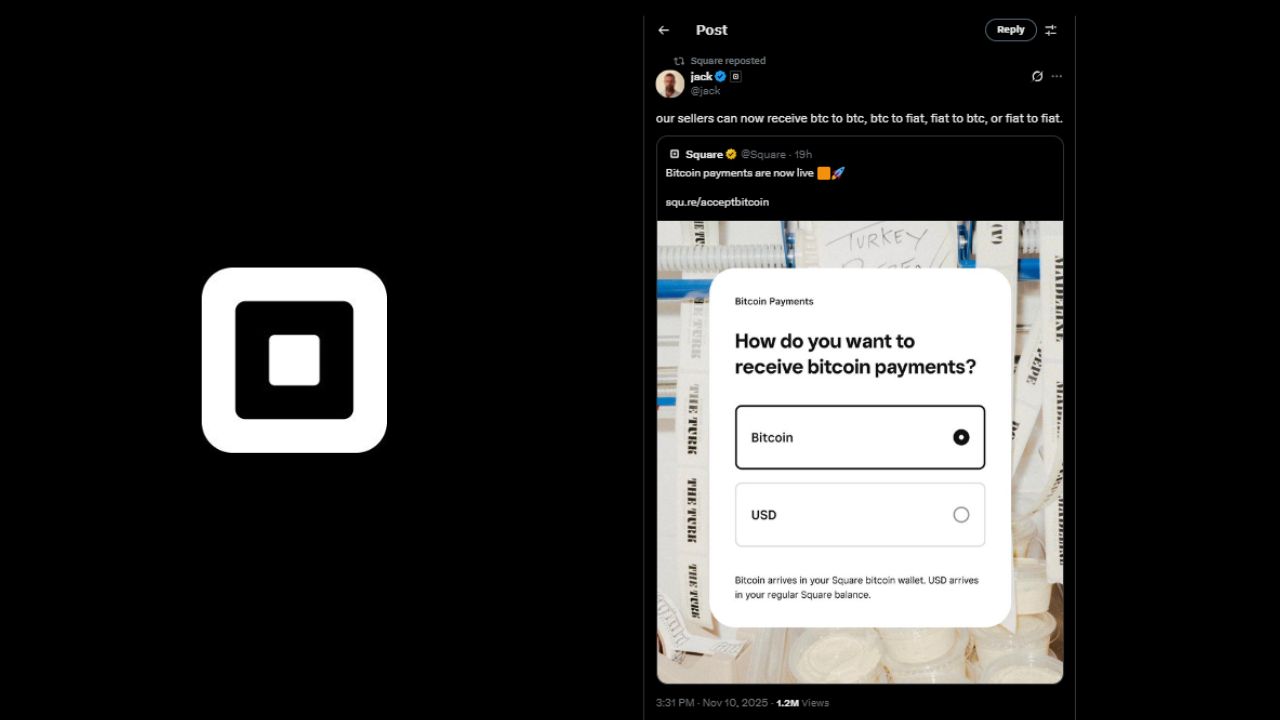

Square officially launched Bitcoin payments on Monday, enabling four million merchants to accept BTC at checkout. Jack Dorsey’s payment processor integrated the feature directly into its point-of-sale system, making Bitcoin a payment option at potentially millions of physical locations across eight countries.

Sellers can choose how they handle BTC transactions; either by receiving Bitcoin directly, converting Bitcoin payments to fiat, or converting fiat sales into Bitcoin. That flexibility removes the biggest barrier for small businesses worried about holding volatile assets. Square charges zero fees on Bitcoin transactions until 2027, then 1% after that. Compare that to credit card processing fees of 1.5% to 4%, and the value proposition becomes clear.

The rollout focuses on in-person transactions at physical stores first. Jacob Szymik, a Square account executive, confirmed that online store functionality and invoicing are under development with updates coming soon. This phased approach lets Square gather real-world usage data before expanding the offering.

Early Adopters Already Using It

The feature went live immediately. Parker Lewis, head of business development at Zaprite, posted on X that he “bought coffee with my own two eyes” at Medici, a coffee roaster in Texas. Katie Ananina, CMO at CitizenX, reported being the first person to pay with Bitcoin at the same location, calling it “absolutely legendary.”

Ananina highlighted how much simpler merchant adoption has become. “For so many years, it was painful,” she wrote, explaining that onboarding businesses previously required educating owners to become Bitcoin advocates themselves. “Today’s Square move makes the entry point so much lower. Huge!”

That’s the key insight. Previous attempts to enable Bitcoin payments required merchants to understand the technology, set up specialized hardware, and manage keys. Square abstracts all of that away. Sellers who already use Square terminals just toggle a setting and start accepting BTC. No education required.

Block’s Cash App launched a live map showing all merchants worldwide accepting Bitcoin payments. Dorsey shared the map, encouraging users to support businesses that enable the feature. He urged followers to not only pay in Bitcoin but convince merchants “to keep it as Bitcoin to help them better survive dollar debasement.”

A July YouGov survey of 1,000 consumers in the U.S. and U.K. found that 37% view payments as a primary use case for crypto. Square’s integration provides the infrastructure to test that thesis at scale across its network spanning the U.S., U.K., France, Japan, and other markets.

The zero-fee incentive through 2027 gives merchants nearly three years to experiment without downside. Even after 2027, the 1% fee undercuts traditional payment processors significantly. For businesses operating on thin margins, saving 0.5% to 3% on processing fees actually matters.

Square’s Bitcoin wallet and payment solution was previously projected for a 2026 launch but arrived ahead of schedule. That acceleration suggests strong demand from both merchants and users. Dorsey has been vocal about Bitcoin’s potential as a payment rail for years. This launch represents his most significant bet on that vision.

The current rollout is limited to POS terminals, but expanding to e-commerce could multiply adoption significantly. Online merchants processing thousands of transactions monthly would see substantial savings from lower processing fees. If Square can match the simplicity of its physical POS integration for online stores, Bitcoin payments could become standard checkout options across e-commerce.

Will Merchants Actually Keep Bitcoin?

Dorsey’s comment about keeping Bitcoin “to survive dollar debasement” reveals his broader thesis. He’s not just enabling payments, he’s positioning Bitcoin as a treasury asset for small businesses. Whether merchants actually hold BTC or immediately convert to fiat will determine if this becomes a payment network or just another off-ramp.

The flexibility to choose matters. Risk-averse merchants can accept BTC and instantly convert to dollars, capturing the fee savings without price exposure. Bitcoin believers can stack sats from customer payments. Most will probably do something in between, keeping a percentage as BTC and converting the rest.

Square’s move removes significant friction for both consumers and merchants. By integrating Bitcoin payments into existing, widely-used hardware, the company eliminates the need for specialized equipment or technical knowledge. The zero-fee incentive and backing from a major payments player could provide the catalyst needed to transition Bitcoin from speculative asset to functional medium of exchange.

Four million merchants represent real distribution. If even 10% enable Bitcoin payments and 1% of customers use it, that’s still thousands of daily Bitcoin transactions for goods and services. The data from this rollout will show whether payment demand actually exists at scale or if it’s still primarily a speculative narrative.

Related

Discover more from Dipprofit

Subscribe to get the latest posts sent to your email.