Eric Trump Reiterates $1 Million Bitcoin Price Target, Says BTC ‘Never Been More Bullish’

Eric Trump, son of U.S. President Donald Trump, doubled down on his prediction that Bitcoin will eventually reach $1 million, stating he has never been more bullish on the leading cryptocurrency. Speaking at the World Liberty Financial forum at Mar-a-Lago on Wednesday, Trump acknowledged Bitcoin’s volatility but argued that its upside potential significantly outweighs associated risks.

The prediction comes as Bitcoin trades below $67,000, having fallen from its 2025 peak above $126,000. Despite the recent pullback in prices, Trump maintained his optimism about the asset’s long-term trajectory during an interview with CNBC.

Trump cited Bitcoin’s historical performance as evidence supporting his bullish stance. Over the past decade, Bitcoin has generated approximately a 70% average annual gain, making it what Trump called “one of the greatest performing asset classes” in recent history. He challenged critics to identify a better-performing asset class over the same period.

The younger Trump’s renewed optimism reflects the broader involvement of the Trump family in the cryptocurrency sector. The family has been deepening its engagement with crypto through the World Liberty Financial venture, which suggests an institutional commitment to digital assets beyond mere speculation.

Bitcoin’s volatility has been a persistent concern for mainstream investors. The cryptocurrency has experienced significant price swings throughout its existence, including sharp corrections from all-time highs. However, long-term holders and bullish analysts have historically pointed to such volatility as a characteristic of emerging asset classes rather than a fundamental weakness.

The $1 million price target represents a significant increase from current levels. If achieved, it would require Bitcoin to appreciate approximately 15 times its current value. Such predictions rest on assumptions about increased mainstream adoption, institutional investment, and the cryptocurrency’s role as a hedge against inflation and currency debasement.

Industry observers have noted that Bitcoin’s performance over the past decade has indeed outpaced many traditional investments, including stocks and bonds in certain periods. This historical track record forms the basis for continued bullish sentiment among cryptocurrency advocates and investors.

The timing of Trump’s comments at the World Liberty Financial forum underscores the cryptocurrency sector’s ongoing efforts to gain legitimacy and attract high-profile endorsements. As regulatory frameworks around digital assets continue to evolve globally, statements from prominent figures carry weight in shaping public perception and investor sentiment.

Bitcoin currently occupies a complex position in financial markets. While it has gained increased acceptance among institutional investors and some corporations, skeptics continue to question its utility and long-term viability. Price predictions ranging from zero to seven figures reflect the wide disparity in market opinion regarding Bitcoin’s future.

Trump’s prediction aligns with other notable Bitcoin bull cases that have emerged from various market participants over recent years. However, the cryptocurrency remains subject to regulatory changes, technological developments, and shifts in investor appetite that could significantly impact its price trajectory.

The statement also reflects confidence in the broader cryptocurrency market’s ability to mature and integrate into traditional financial systems. As stablecoin adoption grows and institutional infrastructure improves, some analysts believe higher valuations for Bitcoin become increasingly plausible, though not guaranteed.

Eric Trump’s continued advocacy for Bitcoin suggests the Trump family views cryptocurrency as a significant component of future financial infrastructure. This positioning may influence policy discussions if political circumstances favor cryptocurrency-friendly regulation in the coming years.

More Reads:

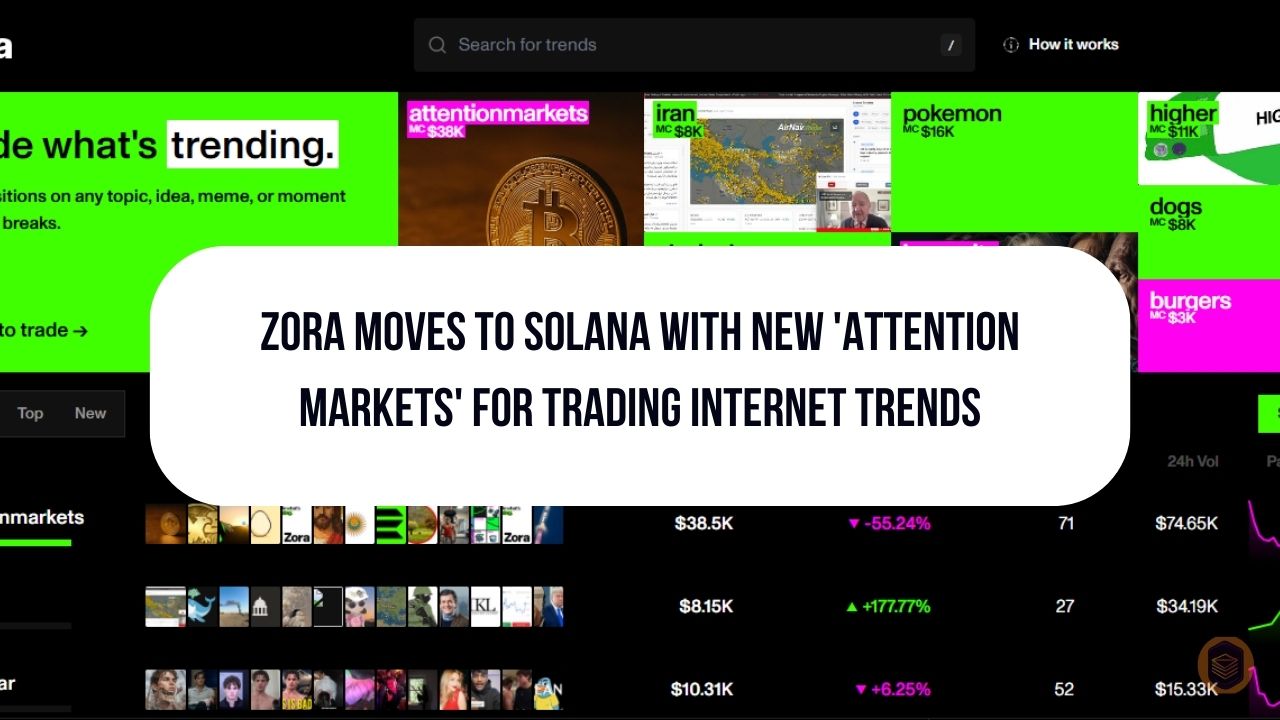

Zora Moves to Solana With New ‘Attention Markets’ for Trading Internet Trends

Grok AI: Elon Musk’s ChatGPT Rival Faces Global Crackdown Over Child Abuse Material

Discover more from Dipprofit

Subscribe to get the latest posts sent to your email.