Bitcoin Hash Ribbon signals miner capitulation as hashrate plunges 20%

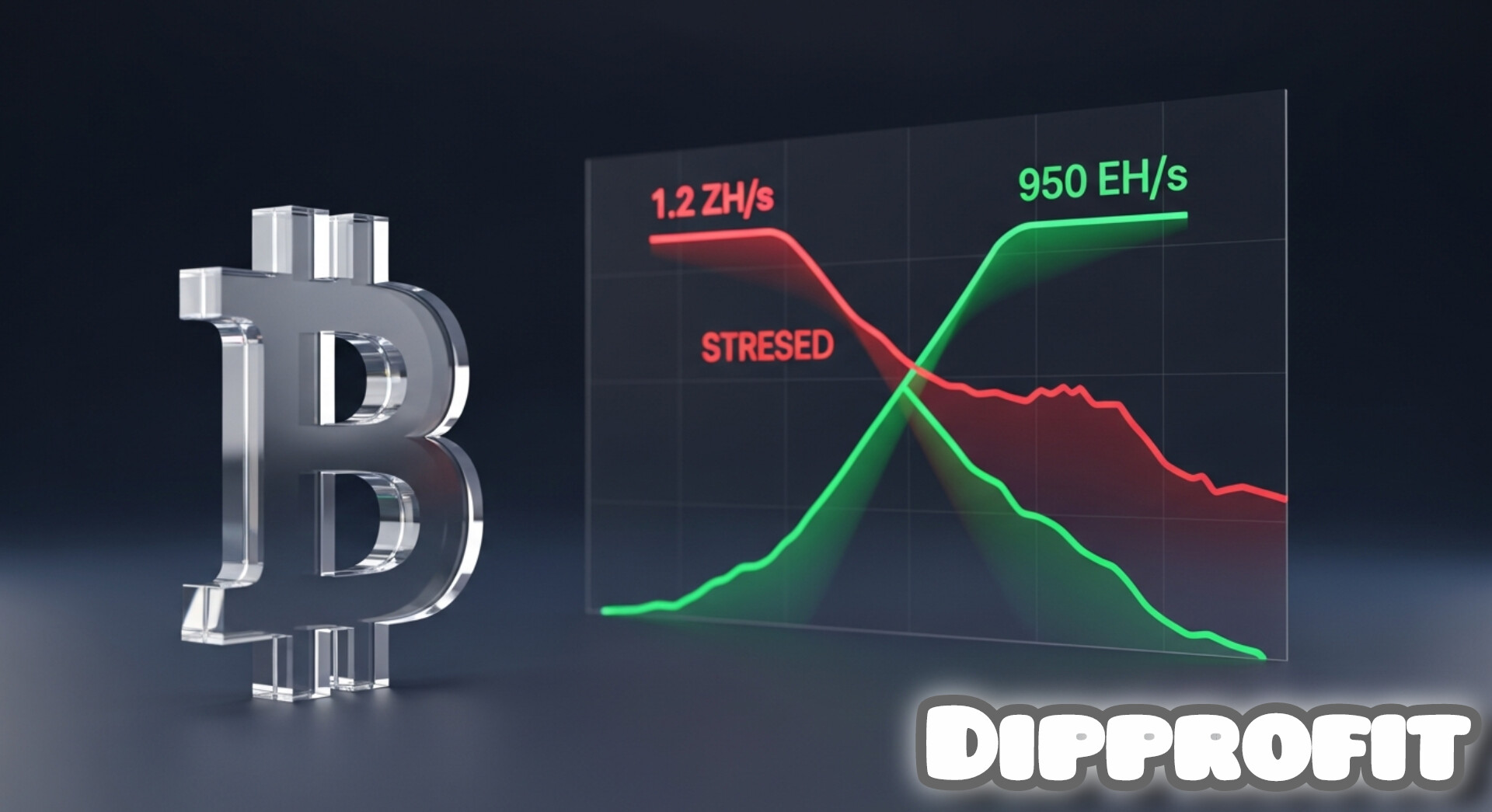

Bitcoin’s hashrate has fallen roughly 20% amid a U.S. storm that disrupted mining operations and squeezed profitability for crypto miners. The computational power securing the Bitcoin network has dropped from around 1.2 zettahash per second to approximately 950 exahashes per second.

The decline has triggered what analysts call miner capitulation, tracked by the Hash Ribbon indicator on Glassnode. This metric monitors the 30-day and 60-day moving averages of hashrate to identify periods when miners are forced to shut down or reduce machines due to unprofitable conditions.

Historically, miner capitulation has preceded significant price rebounds for Bitcoin. The Hash Ribbon last showed capitulation in late November, when Bitcoin formed a low around $80,000. The price has since recovered to approximately $88,000.

The next difficulty adjustment is projected to decline by about 17%, marking the largest drop since July 2021, when China banned Bitcoin mining. Difficulty adjustments maintain consistent 10-minute block times on the network.

According to the Hash Ribbon framework, capitulation is signaled when the short-term average falls below the long-term average, shown in light red on charts. The worst phase is considered over once the 30-day measure crosses back above the 60-day, represented by darker red.

Past patterns suggest recovery opportunities when this crossover aligns with a shift in price momentum from negative to positive. A comparable pattern emerged in mid-2024, when miner capitulation preceded a sharp Bitcoin rally.

In August 2024, following Hash Ribbon capitulation and a yen carry trade unwind, Bitcoin bottomed near $49,000 before rallying to $100,000 in January 2025. The rebound came after the difficulty adjustment period normalized.

Another historical precedent occurred during the collapse of crypto exchange FTX in 2022. Bitcoin bottomed near $15,000 amid miner capitulation, then rebounded to approximately $22,000 once the Hash Ribbon normalized.

Industry observers are now monitoring whether the current pattern repeats and Bitcoin enters a renewed expansionary phase as hashrate and the Hash Ribbon begin to stabilize. The metric remains a key indicator for traders assessing whether current mining stress represents a buying opportunity.

Miners cutting computing power indicate profitability challenges across the sector due to rising operational costs and energy expenses. Higher electricity prices and hardware maintenance costs typically drive such capitulation events.

The timing of the Hash Ribbon indicator’s signals has drawn attention from technical analysts tracking Bitcoin’s price movements. The pattern’s historical accuracy in preceding rallies has made it a reference point for understanding miner behavior during market downturns.

More Reads:

Hyperliquid Dominates Decentralized Futures Trading as Rivals Struggle to Retain Volume

River Crypto Token Surges 1,900% in One Month—What Investors Need to Know

If you’re reading this, you’re already ahead. Stay there by joining Dipprofit’s private Telegram community.

Discover more from Dipprofit

Subscribe to get the latest posts sent to your email.