eToro’s stock (Nasdaq: ETOR) jumped 7% Monday after the social trading platform posted strong Q3 numbers and announced a $150 million buyback program. Assets under administration hit $20.8 billion, up 76% year-over-year, while crypto trading volume exploded 84% in October compared to last year.

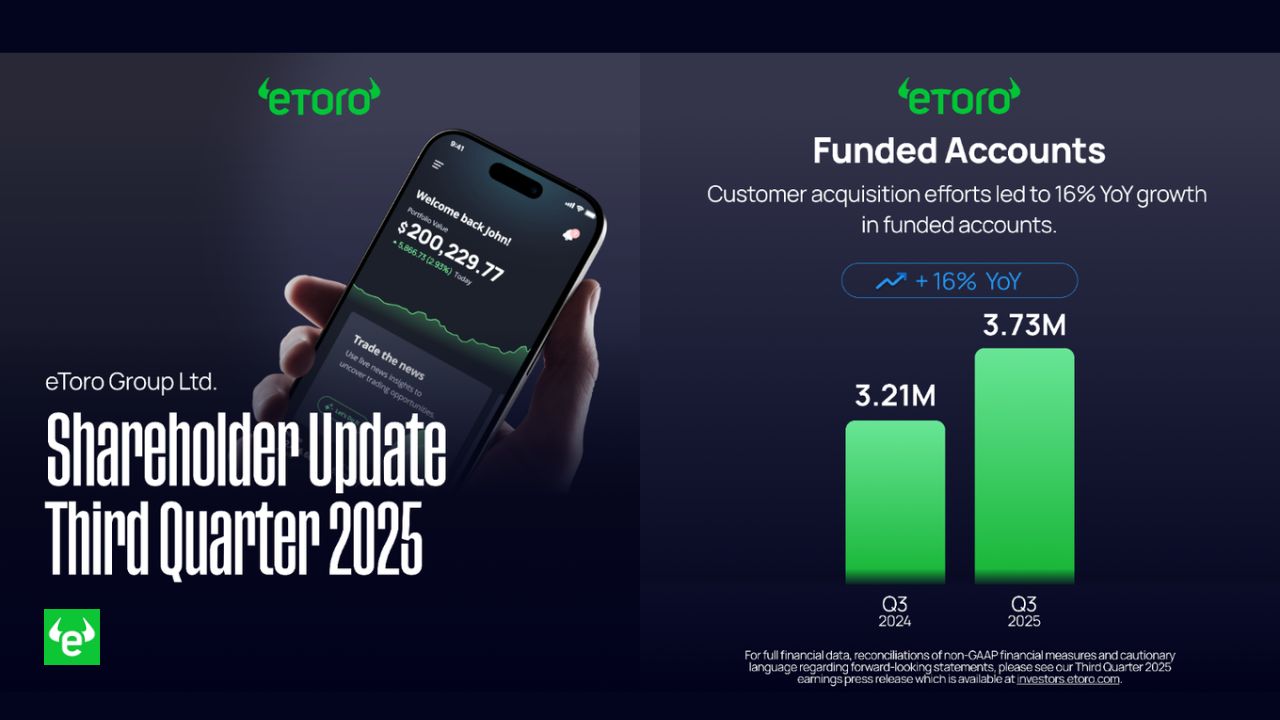

The results show eToro is capitalizing on renewed retail interest in digital assets after taking regulatory heat in 2024. Net contribution reached $215 million, up 28% from $167 million in Q3 2023. GAAP net income rose 48% to $57 million from $39 million. Funded accounts grew 16% to 3.73 million users, helped by the integration of Australian investment app Spaceship.

See also: Crypto Gaming Investments: What You Need to Know

Crypto Trading Volume Explodes

In October, eToro’s platform saw 5 million cryptocurrency trades, marking an 84% year-over-year increase. More importantly, the average invested amount per crypto trade jumped 52% to $320. That’s not just more trades, it’s bigger position sizes. Interest-earning assets reached $8.7 billion, a 55% increase, as users seek yield on their holdings.

CEO Yoni Assia pointed to new product launches, including Tori, an AI-powered analyst for personalized investment insights. But the real story is crypto coming back in a big way. eToro confirmed its crypto wallet will launch within the next few quarters, giving users access to prediction markets, asset tokenization, and DeFi lending protocols.

This is a major turnaround from September 2024, when eToro suspended most crypto trading in the U.S. after settling with the SEC for $1.5 million over unregistered brokerage allegations. The regulatory climate has shifted dramatically under the Trump administration’s pro-crypto stance. SEC Chair Paul Atkins said in September he believes “most crypto tokens are not securities,” essentially giving platforms like eToro a green light.

See also: Mirae Asset Management’s $500B Tokenization Drive with Polygon Labs

Tokenized Stocks Coming to Ethereum

eToro announced plans in July to tokenize 100 of the most popular U.S. stocks and ETFs as ERC-20 tokens on Ethereum. This enables 24/5 trading, breaking free from traditional market hours. This puts eToro in direct competition with Robinhood, which recently launched a layer-2 network on Arbitrum for tokenized stocks in Europe.

The race to bring real-world assets on-chain is heating up fast. eToro is betting that tokenized securities will attract users who want exposure to traditional markets with crypto’s always-on infrastructure. Whether that demand actually exists at scale remains to be seen, but eToro is building the rails regardless.

With $150 million allocated for share buybacks and a clearer regulatory path forward, eToro is positioning itself as a bridge between traditional finance and crypto. The upcoming wallet launch will test whether the company can execute on its vision or if it’s just riding the wave of renewed retail interest in digital assets.

The 76% growth in assets under administration suggests eToro is doing more than just surviving. It’s capturing market share in a competitive landscape where most fintech platforms are struggling to differentiate. Crypto trading volume up 84% while Bitcoin and Ethereum have been relatively flat, showing users are trading altcoins and smaller caps, not just the majors.

Q3 results confirm what the industry already suspected: retail is back. The question is whether eToro can maintain momentum when the next downturn inevitably arrives. For now, the market is rewarding execution with a 7% pop in the stock price.

Discover more from Dipprofit

Subscribe to get the latest posts sent to your email.